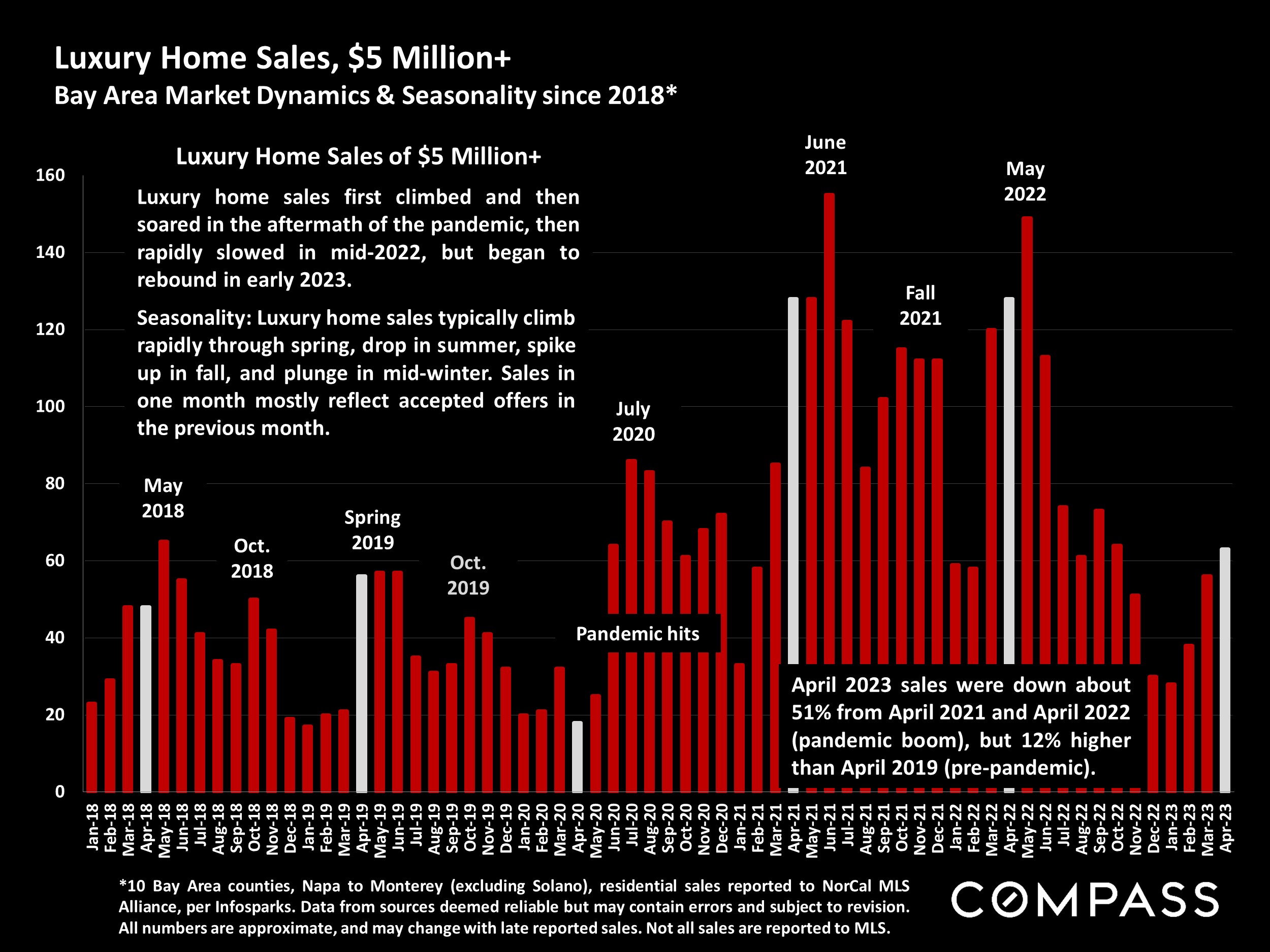

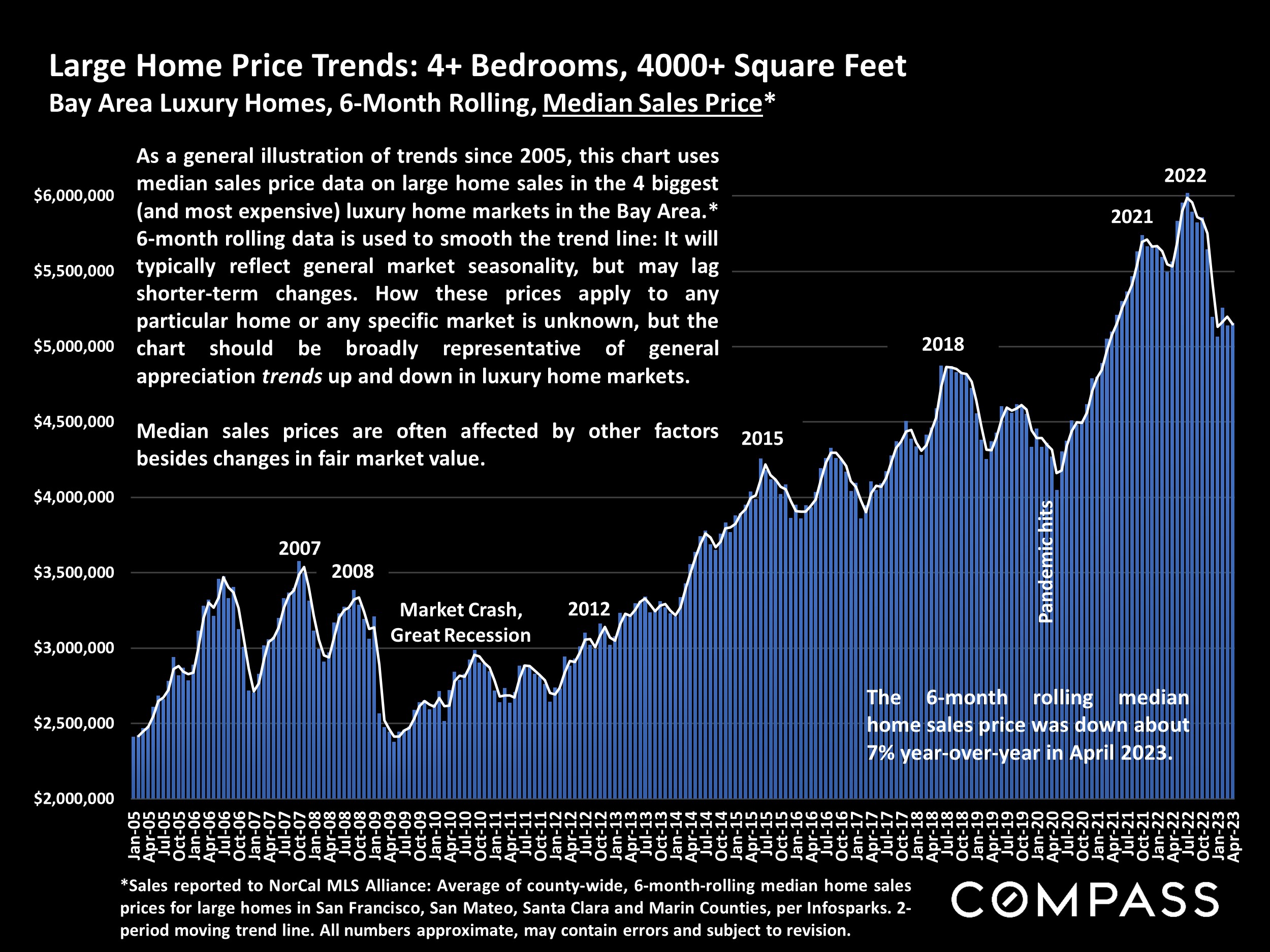

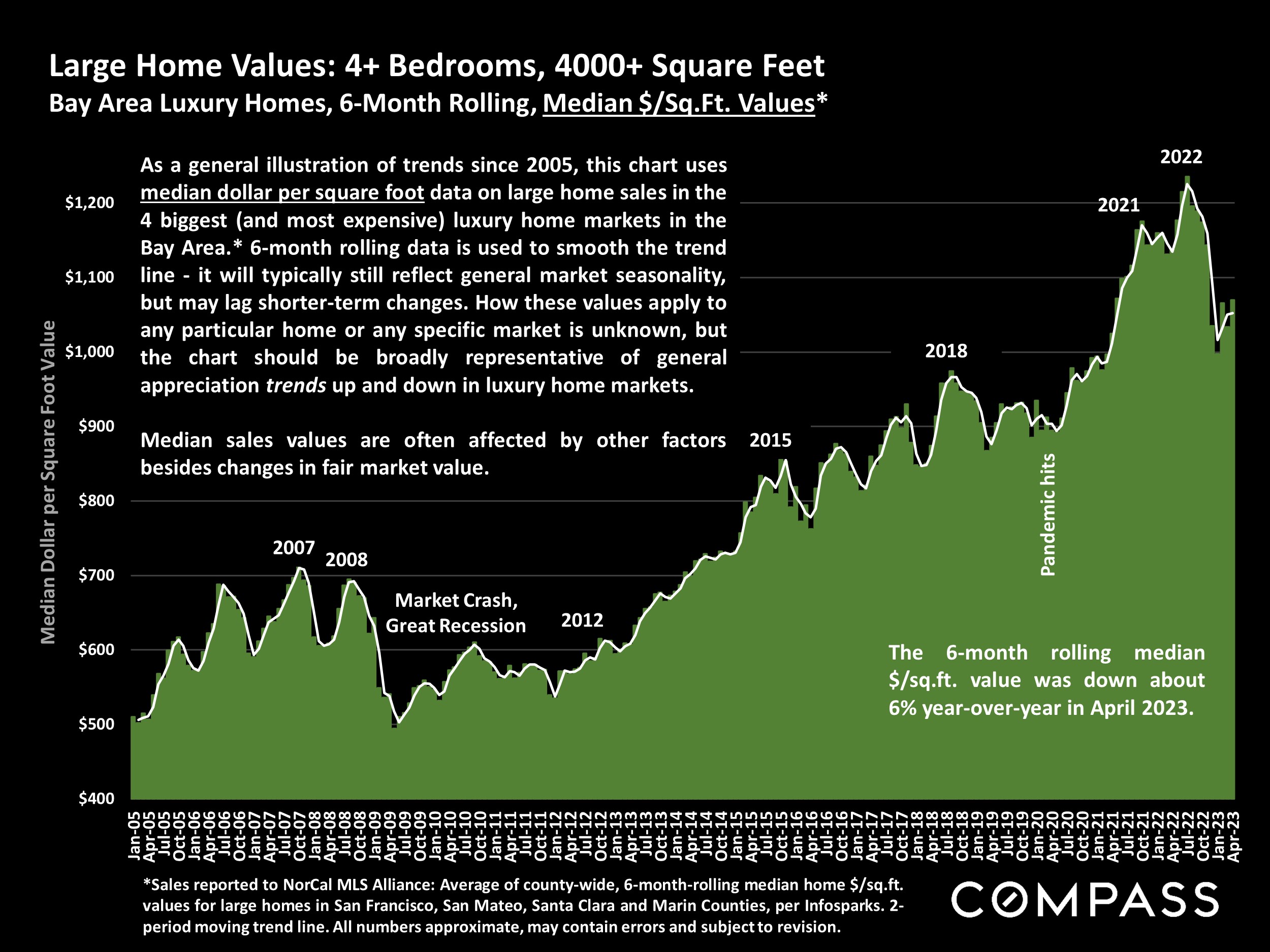

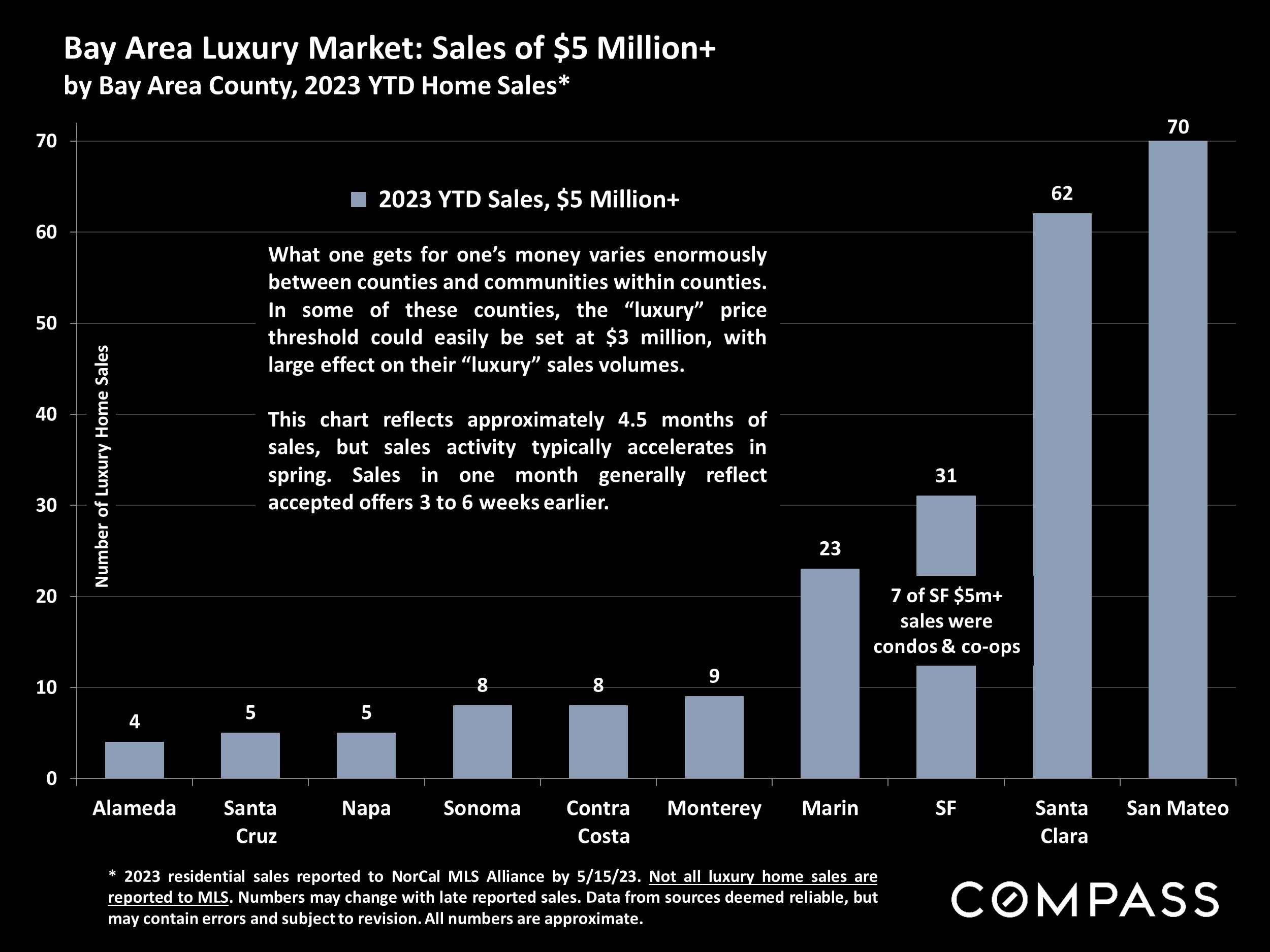

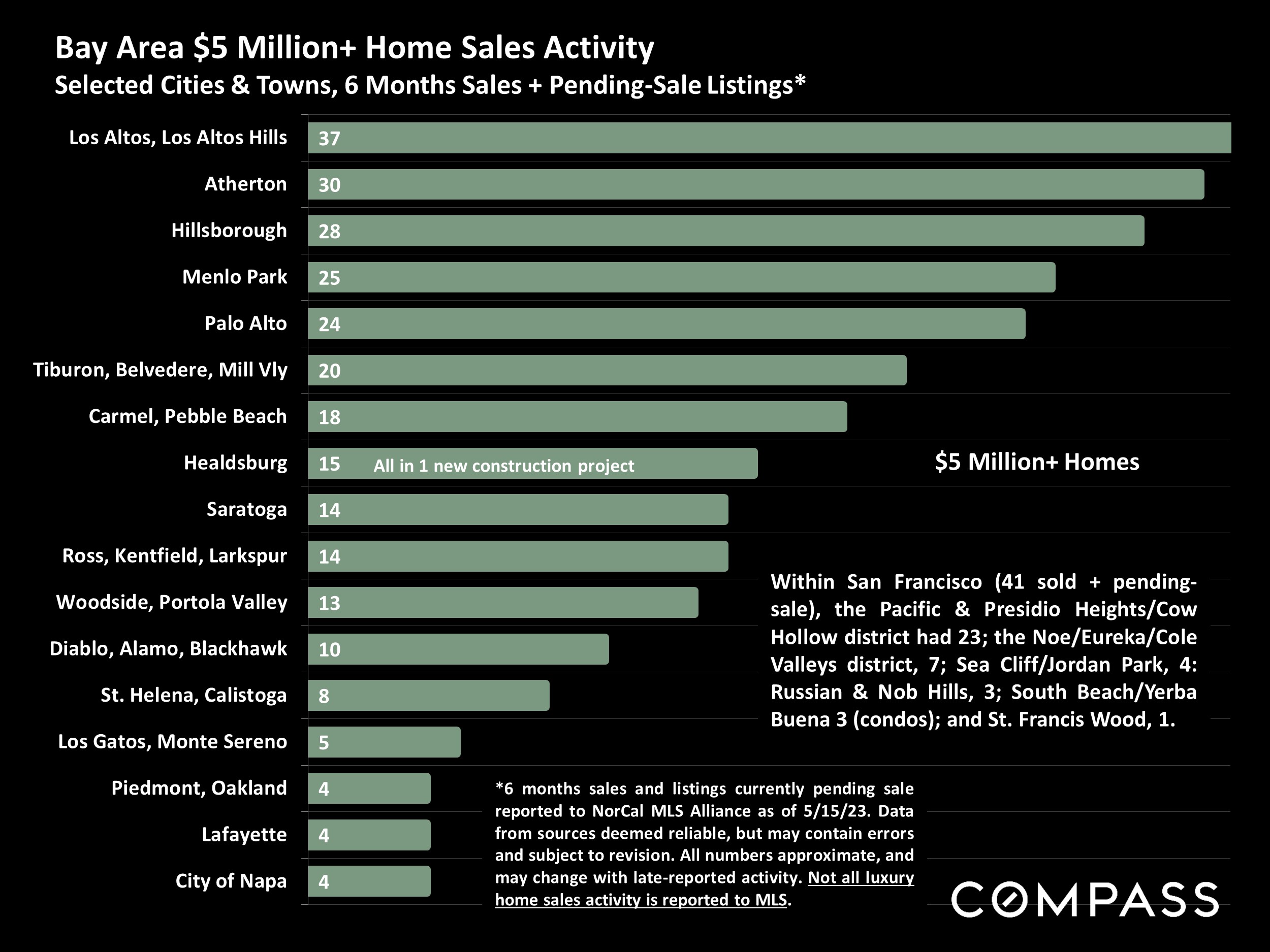

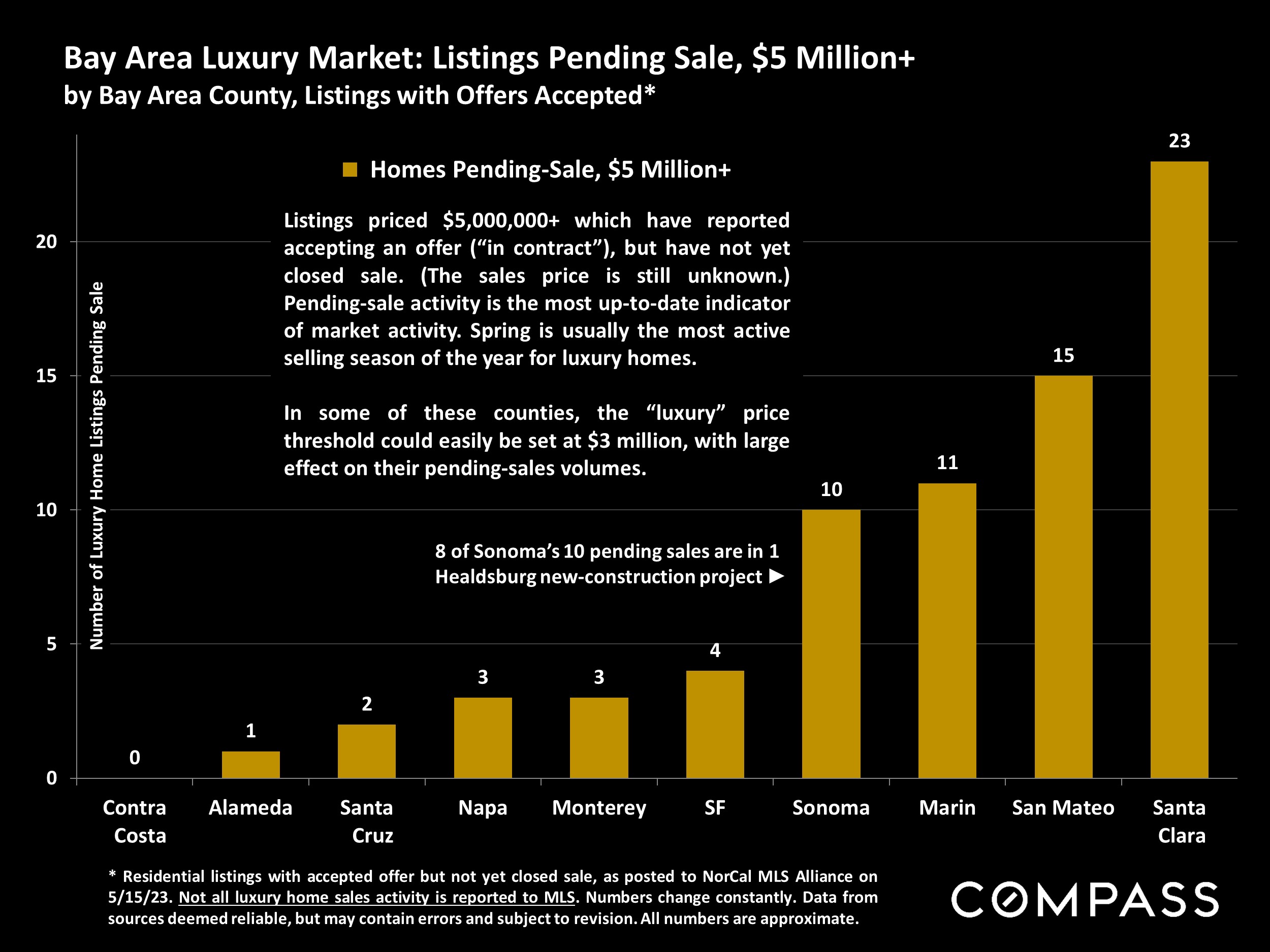

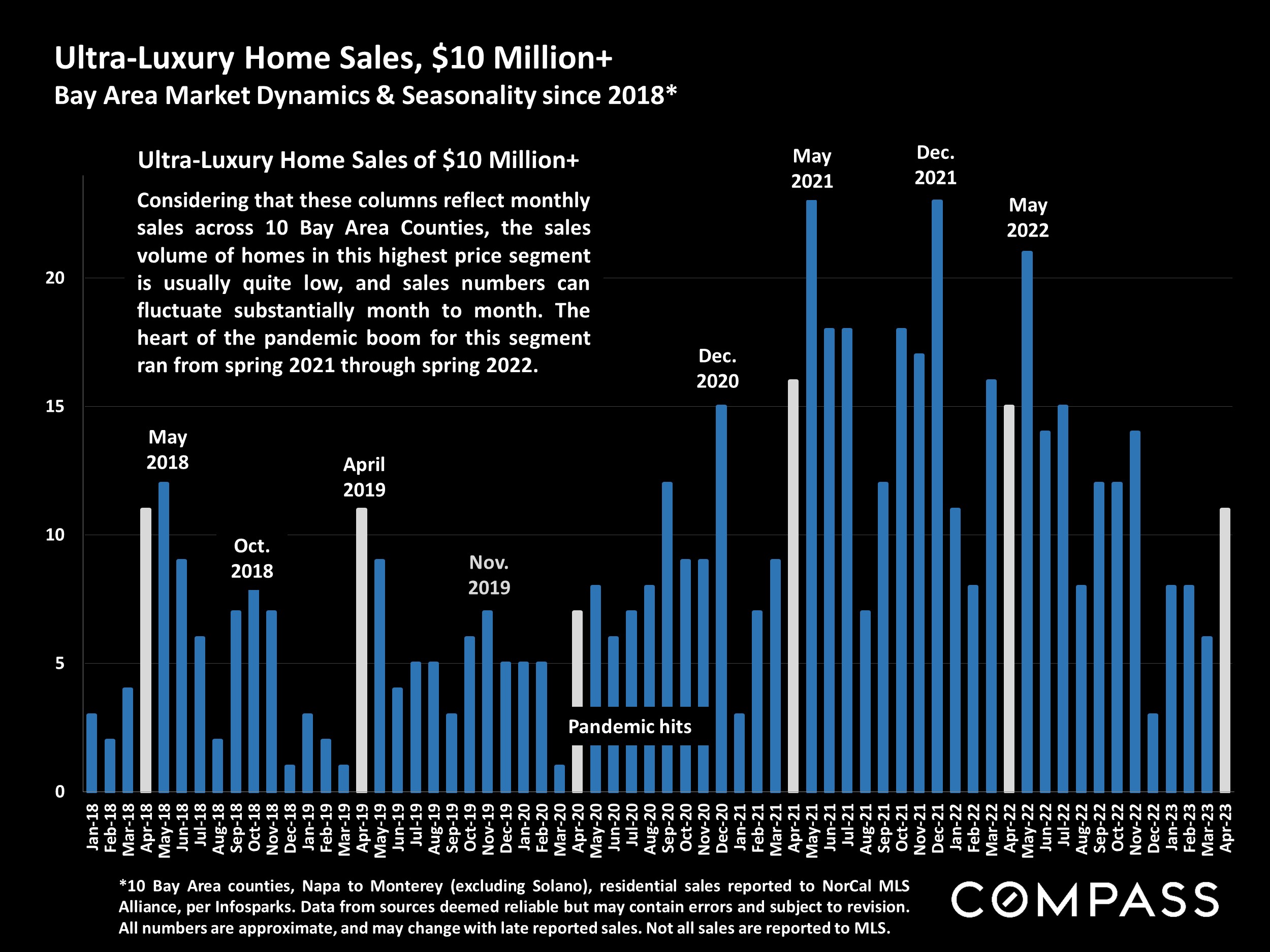

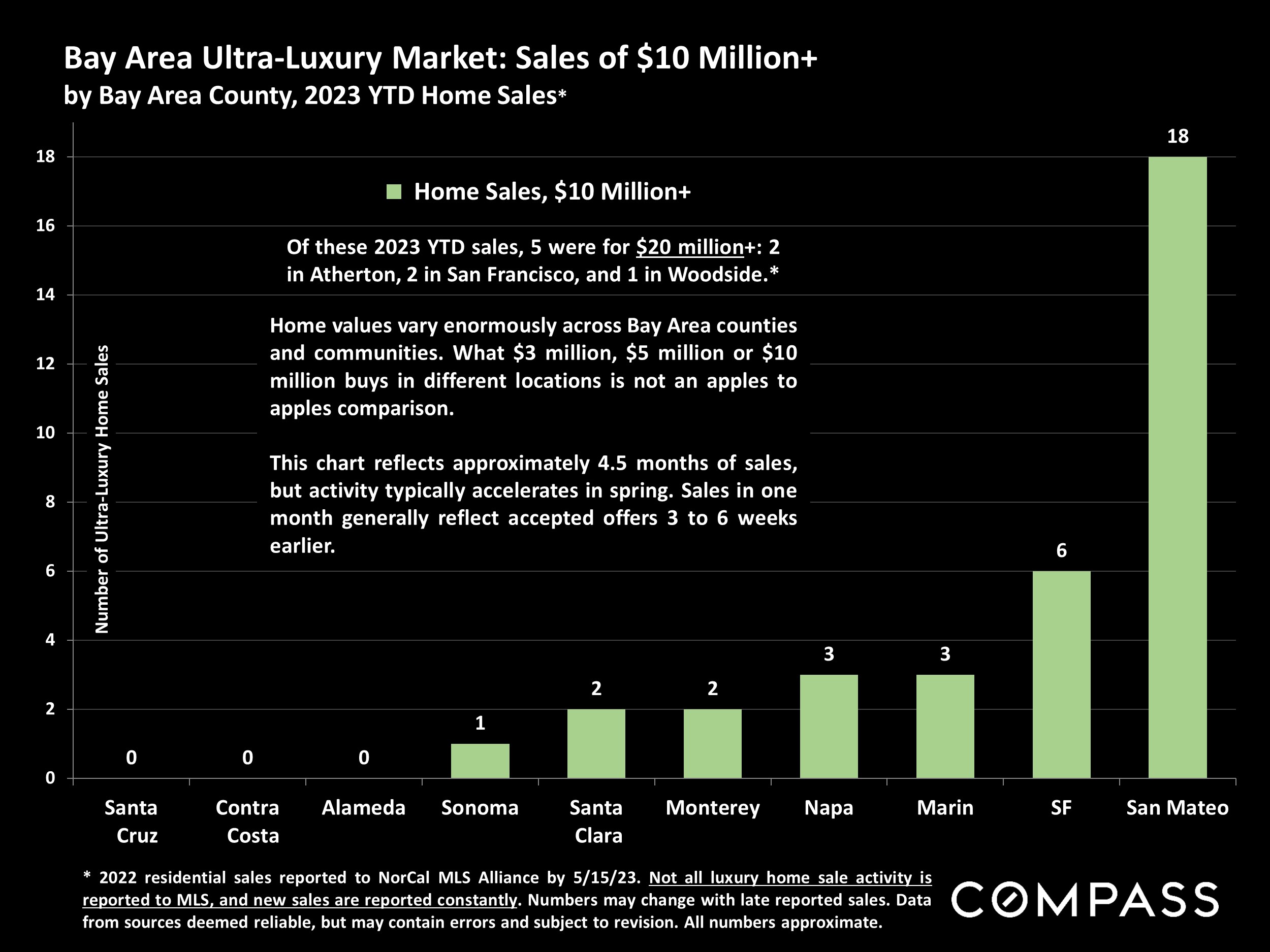

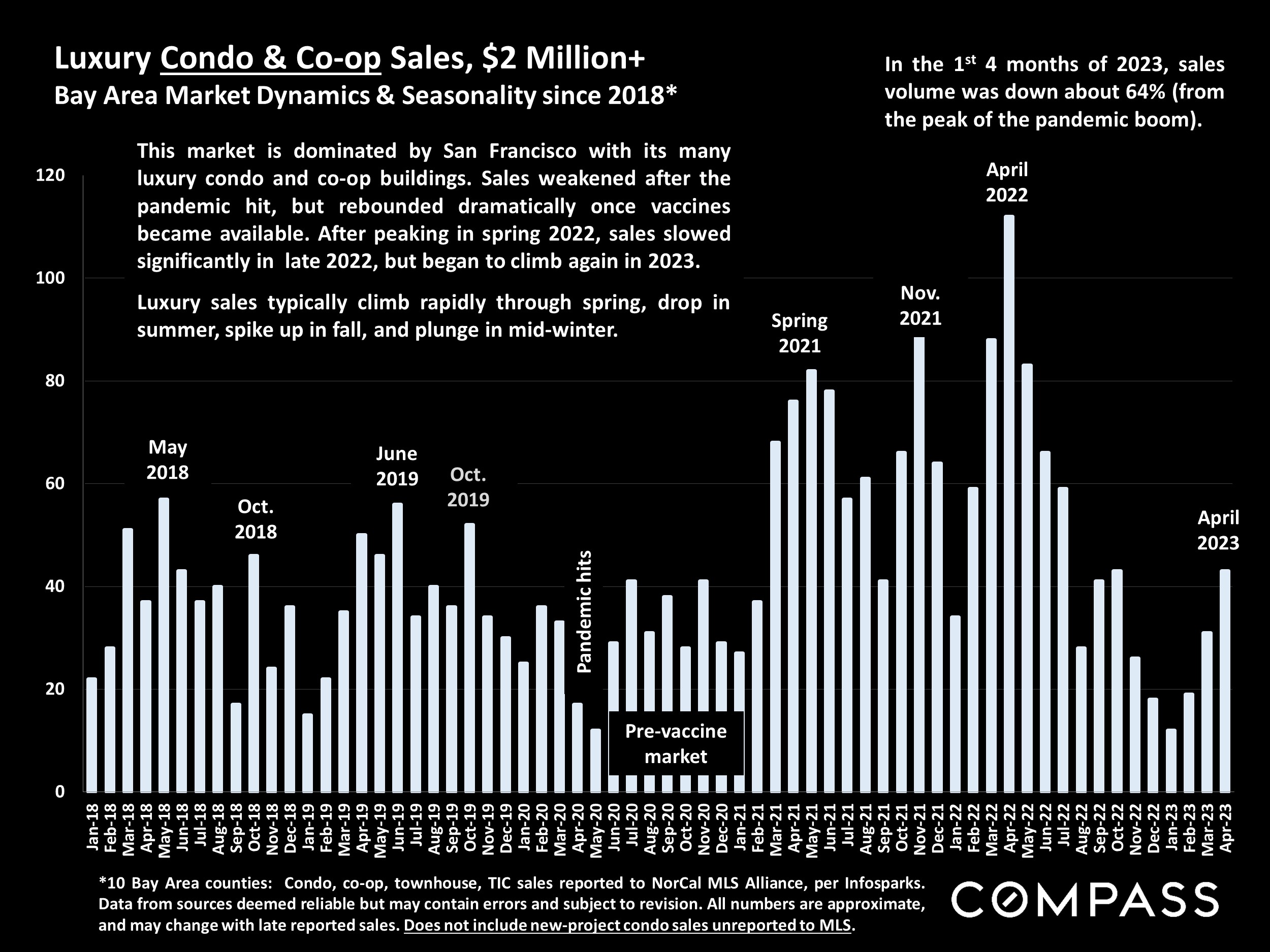

This report will generally look at Bay Area home markets of $5 million+, or, depending on the analysis, at large, higher-price homes of 4000+ square feet. Generally speaking, luxury home sales soared from spring 2020, when the pandemic hit, through spring 2022 (the “pandemic boom”). Economic changes then caused the market to cool rapidly in the 2nd half. In early 2023, buyer demand began to rebound and sales to climb again. On a year-over-year basis, sales are still running far below levels seen last spring at the peak of the pandemic boom, but somewhat higher than before the pandemic. Activity continues to accelerate as we get deeper into the spring selling season.

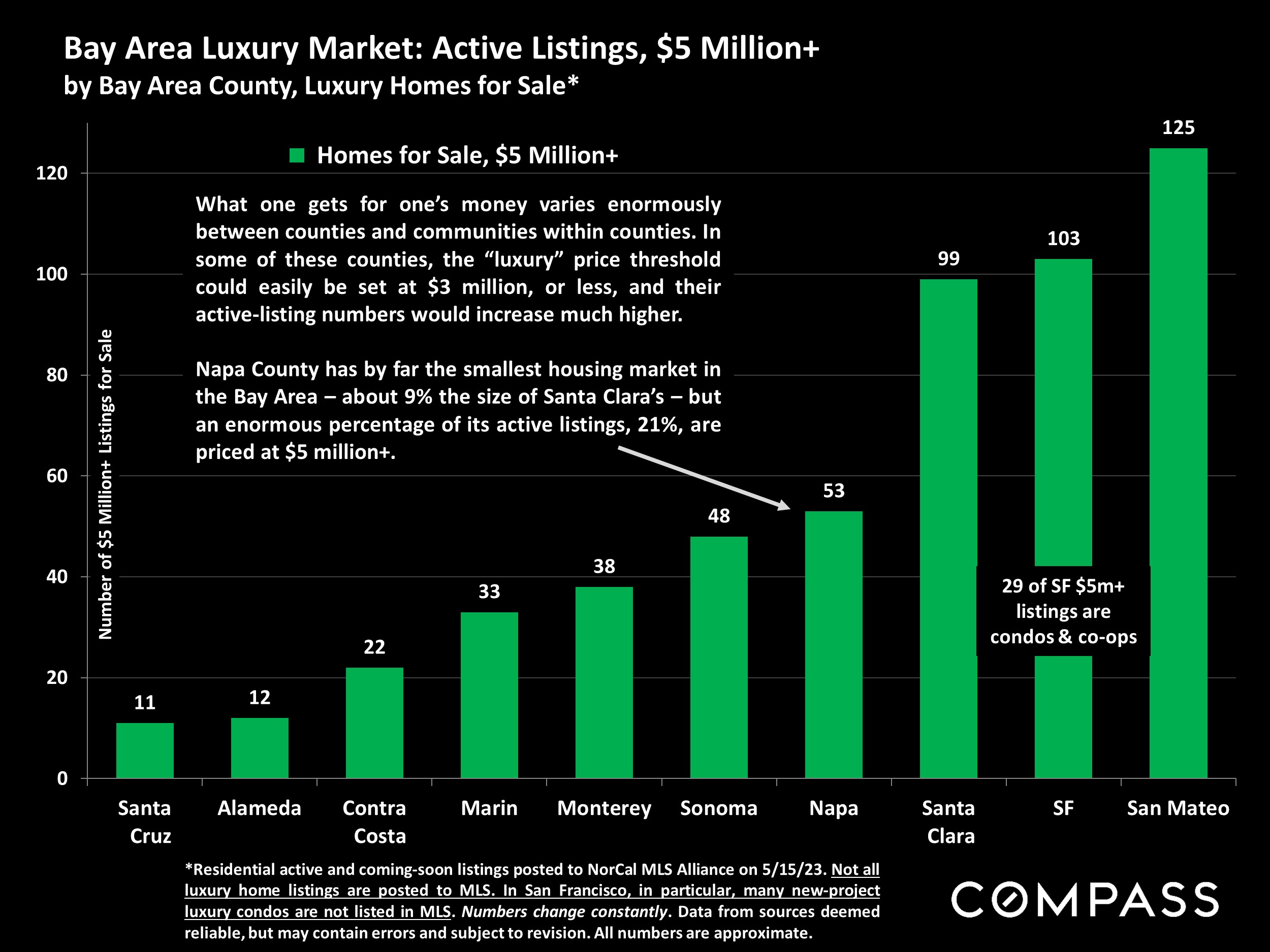

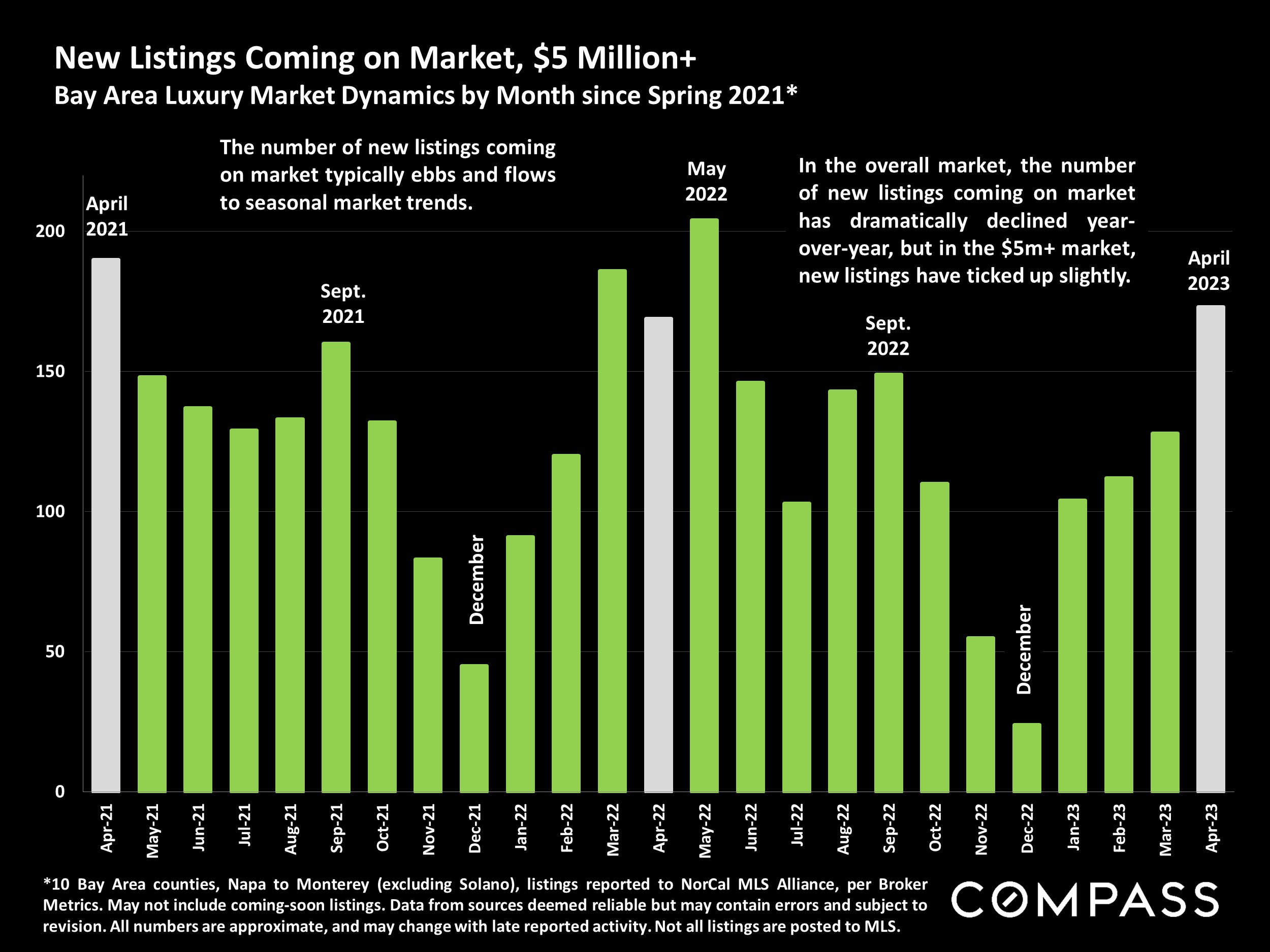

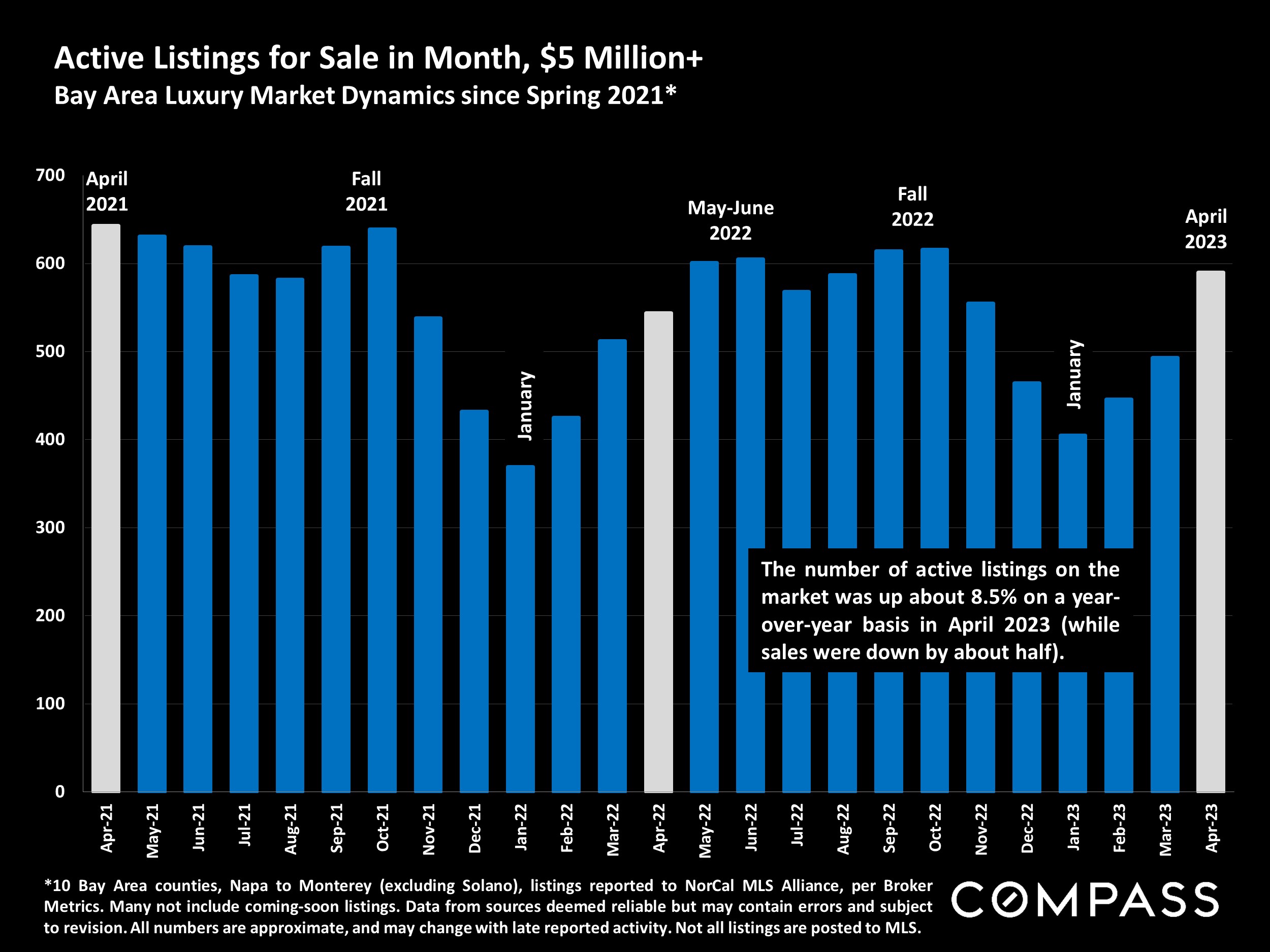

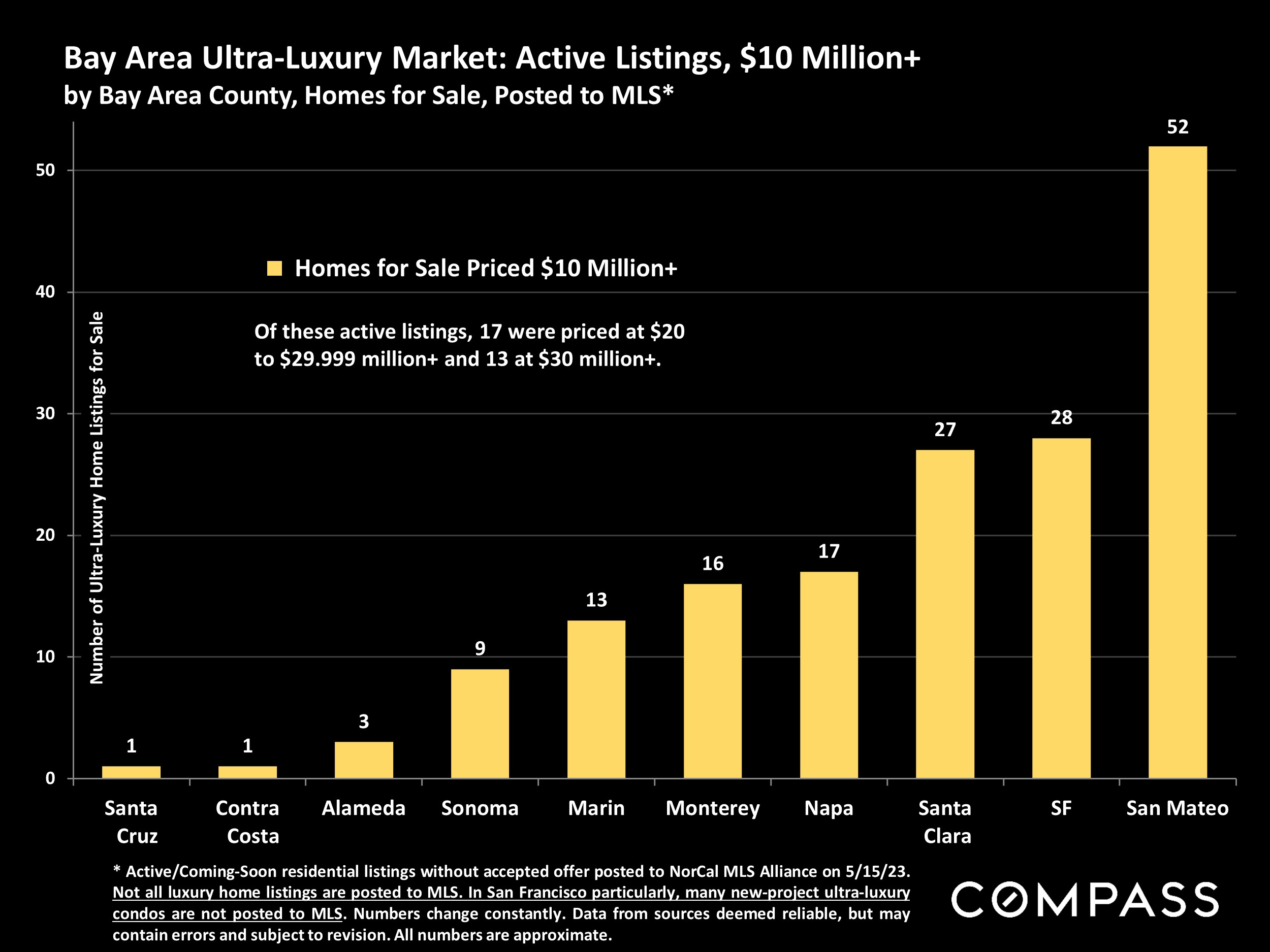

In more affordable price segments, the number of new listings coming on market has generally dropped considerably since large interest rate increases began in early 2022 – this is mostly ascribed to the “mortgage lock-in effect” – but the number of new $5m+ listings in April 2023 was slightly higher year-over-year. Over 540 Bay Area $5m+ homes are now posted to MLS (plus others marketed off-MLS): About a 7 month supply of inventory at the current rate of sale. This substantially changes supply and demand dynamics, with buyers having a much greater choice of listings than in other price segments. For sellers, this means correct pricing is critical.

Within the inner Bay Area, activity in the luxury market typically climbs rapidly through spring, slows in summer, spikes back up in fall (usually with a large surge of new listings in September), and then plunges for the mid-winter holidays. But counties with large second-home markets, such as Napa and Sonoma, can see activity peak in summer with gradual declines thereafter.

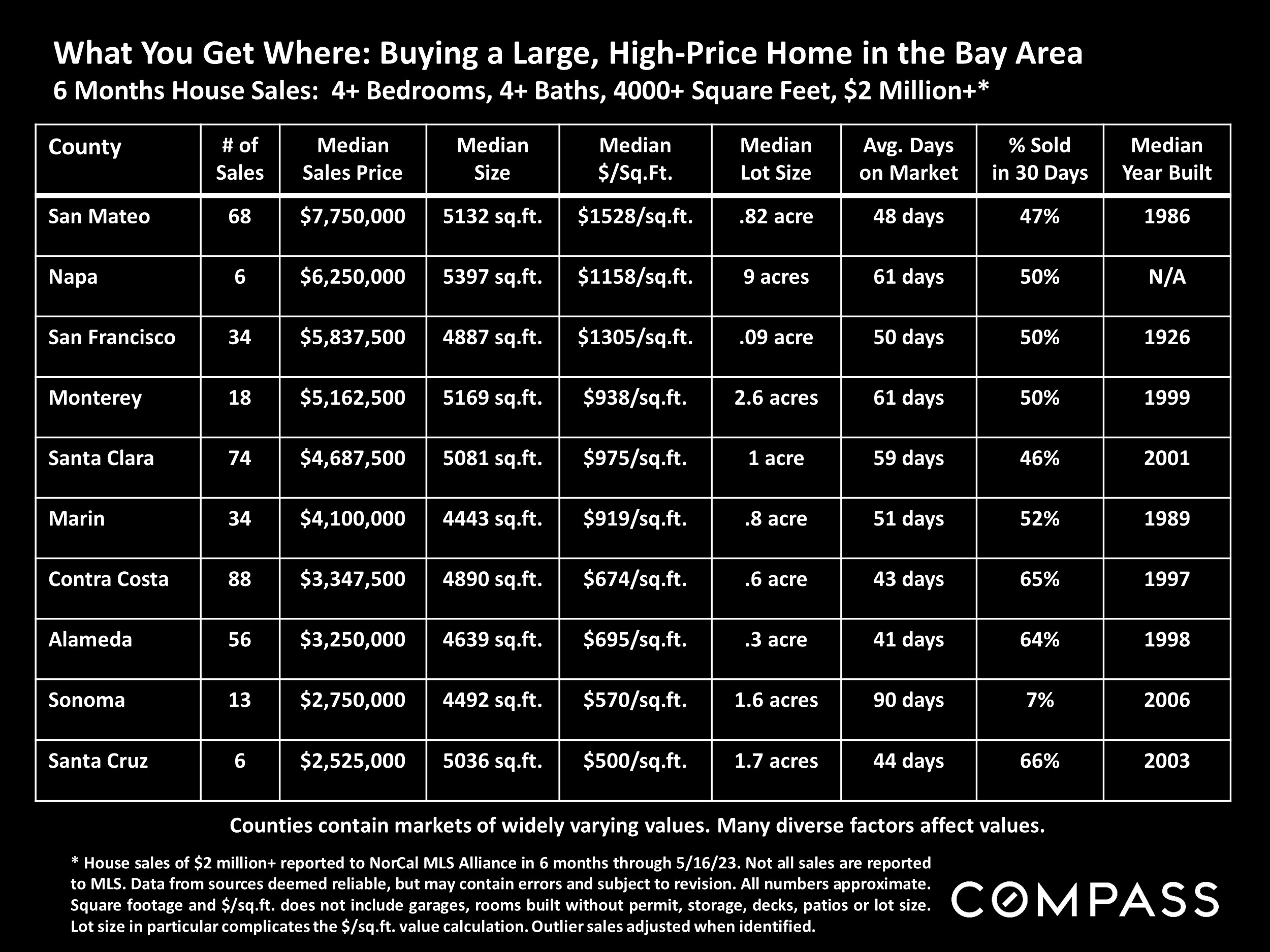

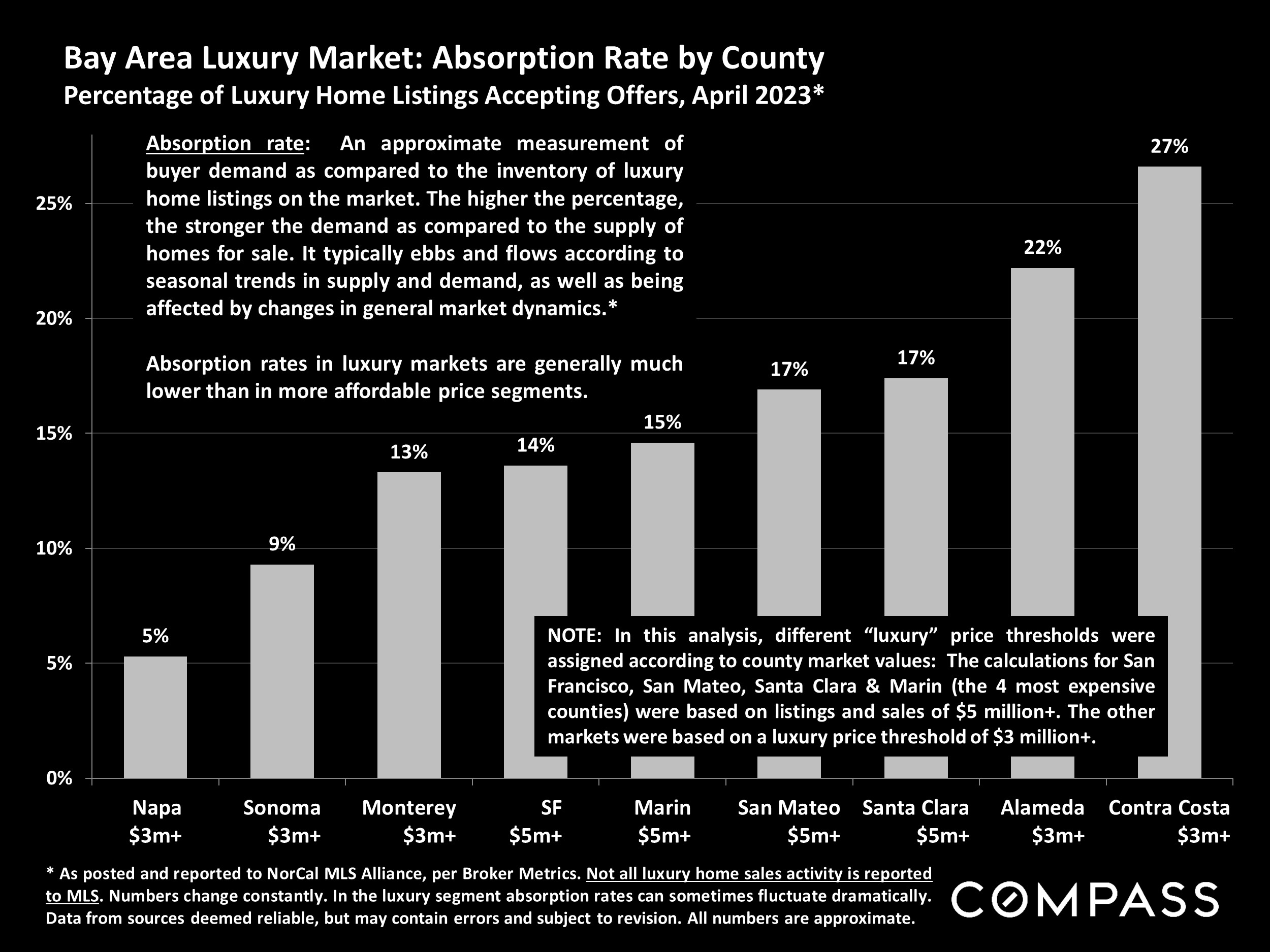

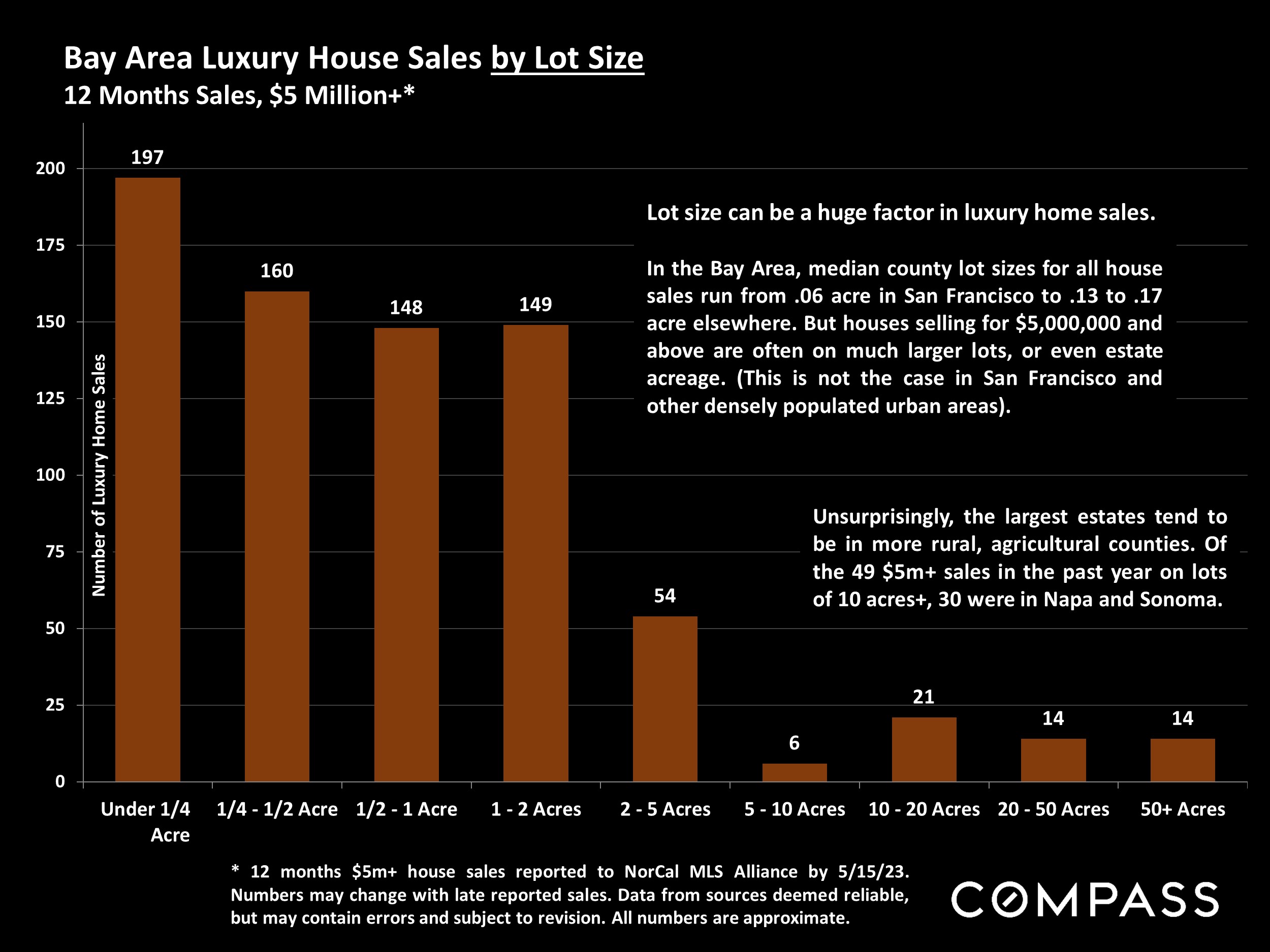

What constitutes a “luxury” home is, of course, a matter of opinion, and factoring in the large differences in values by location, varies widely across the Bay Area. What one gets for however many millions of dollars in any specific city, town or neighborhood varies enormously, and in some locations, $5 million will purchase a huge, immaculate mansion on a 10+ acre estate; in others, a “fixer-upper.” In some Bay Area counties, the threshold for “luxury” home prices could easily be set at $3,000,000, or lower. In real estate, and especially in the market for very special, very expensive homes and estates, the devil is alwaysin the details.

Statistics are very general indicators, and how they apply to any particular property is unknown without a specific comparative market analysis. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by economic events, by changes in inventory and buying trends – especially in the new construction and luxury home segments – as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home’s interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but can be measured in different ways, are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage. Generally speaking, all things being equal, a larger home will sell at a lower dollar per square foot value. Increasing lot sizes, not uncommon in luxury home sales, complicate this calculation.

Typically, the fewer the sales, the less reliable the statistic. This is especially true of areas with sales across a very wide range of individual sales prices, such as is often the case in the most expensive market segments. Longer term trends are more meaningful than short term fluctuations. Data from activity reported to NorCal MLS Alliance, supplemented at times by non-MLS sales data reported in the media. It may contain errors and is subject to revision. All numbers in this analysis are to be considered approximate. How these statistics apply to any particular home is impossible to know without a specific comparative market analysis.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.